Official WeChat

Construction Materials Industry Prosperity Index (MPI) for November 2024 - Construction Materials Industry Operation Stabilized in November Response

1.Construction Materials Industry Prosperity Index in November

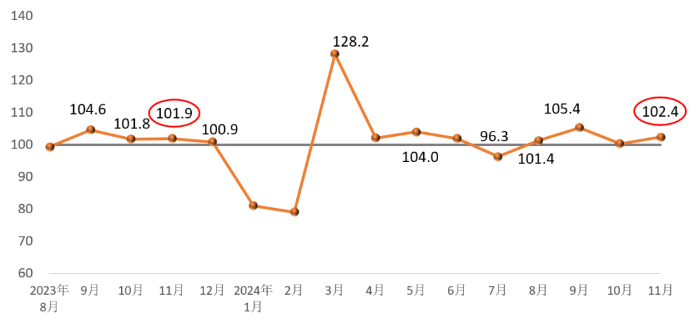

In November 2024, the Prosperity Index of Construction Materials Industry was 102.4 points, up 2.1 points from October, 0.5 points higher than the same month of the previous year, higher than the critical point, in the boom zone, and the industry's economic operation stabilized and replied.

On the supply side, in November, the price index and production index of the construction materials industry were both above the critical point. Among them, the building materials industry price index was 101.4 points, 0.7 points higher than the previous month; the building materials industry production index was 101.0 points, 1.4 points higher than the previous month. Overall, the production and price of building materials products have rebounded. Demand side, building materials investment demand index, industrial consumption index, international trade index are higher than the critical point. Among them, the building materials investment demand index 102.5 points, 2.1 points higher than last month, indicating that the construction market demand than last month's growth; building materials products industrial consumption index 101.4 points, 1.8 points higher than last month, building materials industry chain upstream and downstream of the relevant manufacturing industry demand increased steadily; building materials international trade index 106.5 points, 3.0 points higher than last month, the building materials commodities export trade continues to maintain growth. Overall, in November, the overall market demand for building materials showed a low reply trend, the industry operation remains stable.

2. MPI influencing factors analysis and early warning

Production of building materials accelerated.In November, the construction progress of building projects advanced, the production of downstream related industries accelerated, and the production of building materials stabilized and recovered. Concrete and cement products, waterproof materials, thermal insulation materials, lime gypsum, clay and gravel mining, construction stone, construction technology glass, mineral fiber and composite materials and other 8 sub-industry production index than last month, of which, mineral fiber and composite materials production index rose significantly. Building materials product prices continue to rebound. in November, in the building materials sub-industry, cement, concrete and cement products, wall materials, waterproof building materials, lightweight building materials, thermal insulation materials, clay and gravel mining, construction stone, construction technology glass, non-metallic minerals and other 10 industry product prices rose, the growth of the industry increased by 4 compared with the previous month, the other industries declined slightly. Building materials industry supply and demand continued to repair.

The macro-environment of industry operation is expected to improve. Since the beginning of this year, the relevant state departments to systematically launch and promote the implementation of macro-control policies, the introduction of accelerated issuance of ultra-long-term special treasury bonds, the resolution of local government special bonds, to carry out large-scale equipment renewal and consumer goods for the old and a series of policy initiatives to promote the steady expansion of the scale of effective investment, with a series of policies to further land, will further boost economic vitality and enhance market expectations. Under the market relationship of supply exceeds demand, the building materials industry should objectively analyze the policy implementation cycle, continue to pay attention to the effect of the policy, cautiously judge the subsequent market changes, avoid blindly accelerate production, and continue to promote the dynamic adjustment of supply and demand relationship repair.