Official WeChat

Construction Materials Industry Prosperity Index (MPI) for October 2024 and MPI Adjustment for 2024

I. Construction Materials Industry Prosperity Index for October 2024

(I) Construction Materials Industry Prosperity Index in October

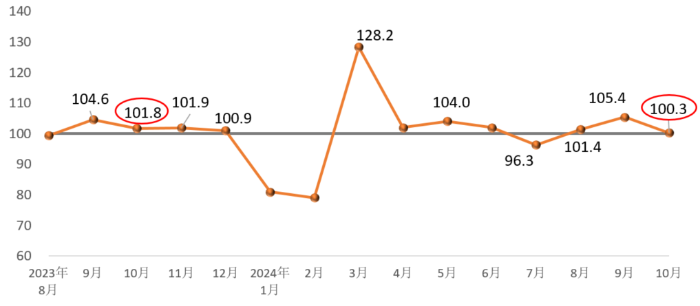

In October 2024, the Prosperity Index of Construction Materials Industry was 100.3 points, down 5.1 points from September, 1.5 points lower than the same month of the previous year, slightly above the critical point, in the weak prosperity zone, and the industry's economic operation remained stable.

On the supply side, in October, the price index for the construction materials industry was above the critical point and the production index was below the critical point. Among them, the building materials industry price index 100.7 points, 0.5 points higher than last month; building materials industry production index 99.6 points, 5.6 points lower than last month. Overall, the price of building materials products rose from the previous month, building materials production fell back from the previous month.

Demand side, building materials investment demand index, international trade index is higher than the critical point, industrial consumption index is lower than the critical point. Among them, building materials investment demand index 100.4 points, down 5.4 points from last month, the construction market demand continues to recover, but the speed of response slowed down compared to last month; building materials products industrial consumption index 99.6 points, down 5.3 points from last month, building materials industry chain upstream and downstream of the relevant manufacturing industry demand is weakening; building materials international trade index of 103.5 points, 6.1 points from last month, building materials commodities export trade driver The effect is more obvious. Overall, in October, the building materials market demand showed a low adjustment trend, the old and new kinetic energy conversion adjustment, industry economic operation is basically stable.

(II) Analysis of factors affecting MPI and early warning

In October, the overall production of building materials remained stable, the production trend did not show obvious fluctuations, but the production index of 7 sub-industries such as cement, concrete and cement products, wall materials, lightweight building materials, mineral fibers and composites, building sanitary ceramics, non-metallic minerals and so on rebounded compared with the previous month, and the production index of lightweight building materials rebounded significantly.

In October, in the building materials sub-industry, cement, concrete and cement products, waterproof building materials, lime gypsum, construction stone, construction technology glass and other 6 industry product prices rose slightly, other industries fell slightly. Dynamic adjustment of supply and demand in the building materials industry, but no significant improvement.

The macro-environment of the industry is expected to improve. Recently, the country to increase counter-cyclical regulation, introduced a package involving monetary, financial, investment, consumption, real estate and other areas of the combination of incremental policies, the building materials industry is expected to improve the macro-environment, the industry's operating fundamentals to support the role of some enhancement. But the current industry supply and demand continues to show a weak balance, growth is still marked uncertainty. Recently, the coal supply is loose, but with the winter coal peak is gradually approaching, the key areas of coal supply will produce a small disturbance in the coal market supply and demand; in October, the high price of natural gas, water transportation, highway freight index is at a high level during the year, increasing the cost of the industry's operations.

II, 2024 building materials industry boom index adjustment

In 2024, the development of building materials industry instability, uncertainty factors increased significantly, the operating environment pressure than expected, market demand weakened, product production slowed down, prices continued to be low, the industry as a whole showed a weak operating situation, boom less than expected.

Demand side:

Investment market demand weakened significantly.2024, the state of the real estate industry is still to continue to prevent risks, accelerate the construction of a new development model is the main focus, real estate investment and other major indicators fell more than expected, the first three quarters of the country's real estate development investment fell by 10.1% year-on-year, year-on-year decline continued to expand by 1 percentage point; the state preventing and resolving the risk of local debt intensified at the beginning of the year in Tianjin, Inner Mongolia and other 12 Provinces were required to strictly control new government investment projects, the relevant impact spread to many places across the country, the national infrastructure investment contraction, the first three quarters of the national infrastructure investment growth rate fell 2.3 percentage points year-on-year. Comprehensive judgment, 2024 investment in the field of building materials industry pulling role weakened significantly, building materials investment demand index 89.5 points.

The market in the field of industrial consumption is slowing down steadily. In 2024, China's domestic demand market to maintain growth, but automobiles, solar cells, household appliances and other building materials, such as the main consumption areas of product output growth rate slowed significantly, the first three quarters of automobiles, solar cells, household appliances production growth rate than the same period of the previous year, respectively, 1.9 percentage points, 50.4 percentage points, 7.2 percentage points, the role of the demand for building materials pulling weaker than expected. Comprehensive judgment, 2024 building materials products industrial consumption index 100.1 points.

Foreign trade amount declined. 2020-2023, China's building materials commodities foreign trade export amount hit a record high, by the high base, export volatility retracement and other factors, 2024 building materials commodities export amount showed a decline trend. Comprehensive judgment, the international trade index of building materials in 2024 is 93.5 points.

Supply side:

The production of building materials industry fell back. Affected by the weakening of market demand, although the output of technical glass, composite materials, sanitary ceramics and other products related to the market in the industrial and consumer fields maintains growth, the output of cement, cement products and other bulk building materials products used in construction declines sharply, and the overall production of building materials industry continues to slow down. Comprehensive judgment, 2024 building materials industrial production index 97.8 points.

The ex-factory price of building materials products declined. 2024 building materials market supply and demand balance continued to adjust, supply exceeds demand characteristics obviously, market competition intensified, building materials product prices lack of stable support, the annual market price is stable but weak downward trend is more obvious. Comprehensive market demand changes and supply situation in the year comprehensive judgment, 2024 building materials industry price index 94.2 points.

Comprehensive judgment: in 2024, the building materials industry overall weak demand, weak supply, low price characteristics, the annual boom index was revised to 92.2 points. 2025, under the stable growth is expected, building materials investment market demand is expected to stabilize, industrial consumption is rising steadily, foreign trade slowed down in the decline, the industry production and prices stabilized at a low level, the boom degree of recovery compared with the year 2024.